ARTES 25 Years of Telecom: Today's challenges and opportunities

As ESA’s umbrella programme for telecom, ARTES, celebrates its 25th year, we will be examining why it was set up, how it and the European satcom environment have evolved, the opportunities and challenges that both face today, and what the future holds.

The satellite communications market is in flux.

Netflix, Amazon Prime, Hulu; chances are you use at least one of these on-demand online services – most people do. Traditional television is being watched by fewer and fewer people, whilst broadband internet is overwhelmingly being supplied by terrestrial fibre networks, not satellites.

Revenue from satellite TV services – the satcom industry’s traditional ‘cash cow’ – flattened for the first time in 2016 and has not recovered. Combined with the ever-dropping cost of bandwidth, this has forced satellite operators to tighten their belts.

Satellite manufacturers have taken a larger hit, recording an average 13% drop in revenues in 2016, as their customers order fewer satellites and components.

fewer satellites and components.

This is expected to have a knock-on effect to other areas of the space sector, with launcher companies no longer seeing the steady demand for the big geostationary telecom satellites that have historically made up the majority of their income.

As examined in the previous instalment of this series, however, ESA’s ARTES programme of Advanced Research in Telecommunications Systems has been bucking this trend. Created in 1993 with the mandate to foster the competitiveness of Europe’s satcom industry, it has been doing so ever since.

Over the past decade, the ARTES programme has produced an average return on investment (RoI) of 2.8. This means that every Euro ESA invests in a project generates 2.8 times that amount in revenue; a rate that is increasing annually.

The nature of that initial investment has also evolved over the years. Most ARTES projects used to be co-funded fifty-fifty between ESA and the company; but in the past few years the rising RoI has started to attract private investors to the downstream sector. These now contribute an average of 25% of the total seed investment.

Today, ESA’s efforts are geared towards further improving RoI, by helping industry create new areas of business, so it can continue to innovate and thrive in an increasingly challenging and fast-moving market.

Today, ESA’s efforts are geared towards further improving RoI, by helping industry create new areas of business, so it can continue to innovate and thrive in an increasingly challenging and fast-moving market.

These efforts are focused on several key domains.

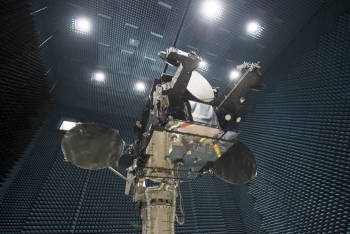

The first is R&D to improve the core competitiveness of satcom technology and products. As important now as it was in the 1990s, ESA has supported hundreds of companies, representing every facet of satcom technology, in designing ever-better, more efficient components. The net effect is to give European and Canadian industry a solid foundation of cutting-edge technology.

The second is downstream commercial applications. Space-based services are increasingly part of everyday life. From healthcare, to tourism, to sustainability, there is a burgeoning demand for space-enabled services, and ESA’s Business Applications programme helps fund their development.

Together, the satcom R&D and Business Applications programmes have worked with more than 500 European companies over the past decade.

The third domain addresses entirely new technologies and markets that can counteract the declining revenue from TV broadcasting.

A prime example is laser communication, an area in which Europe is already a technological frontrunner, and which ESA believes to be the basis for the next revolution in satcom.

Traditional satcom radio frequency (RF) bands are experiencing bottlenecks as we use more and more of this finite resource; and optical links overcome this by bringing unprecedented transmission rates, resilience and security to meet future commercial needs.

Sending information over lasers is also more secure. Optical links are extremely difficult to intercept, and space-based quantum cryptography can increase the reach of secure networks by sending encrypted photon data keys over much larger distances than can be done with optical fibre.

This is important because secure communications in general are themselves a massive and fast growing global market that is very important to governments and private users, for example in maritime surveillance, disaster response and infrastructure monitoring.

In fact, the market is projected to grow from US $4.6 Bn in 2020 to US $6.5 Bn dollars by 2025 and civil use of governmental satcom is expected to more than double, reaching 70% of future demand by 2040.

Arguably the biggest opportunity of all is satellite for 5G.

The next generation of data services, 5G, can offer more capacity, security and lower latency than any previous generation: and satellites can help spread 5G’s always-on, ultra-fast connectivity across the globe, supplementing terrestrial networks.

This huge future market includes sectors like transport and logistics, safety and security, and media and broadcasting, all of which need the reach, reliability and security of space to fully realise the potential of 5G.

ARTES is working with the satcom community to develop the most competitive products and services in all of these areas, helping to turn the present challenges into an opportunity to diversifyand build a future in which space services are a constant, unquestioned part of our daily lives.

Join us in three weeks’ time to find out what a vision of this future might look like, and what that could mean for Europe’s space sector.